This article is based on the available data and my analysis up to 2025. It doesn't accurately predict future events but analyzes what could occur if the US-China tariff tensions continue. It's wise for us to prepare, as all around the world have already taken steps in case it worsens.

1.0 THE FUTURE

I think the world is moving into an era of economic realism and strategic alignment. Tariffs, trade blocs, and new financial instruments are only the surface. Underneath lies a deeper transformation in how nations perceive sovereignty, resilience, and growth. In this fluid landscape, agility and diplomacy not dominance will define future prosperity.

By now, I am sure that everyone is aware of how China responded to the United States’ imposition of import tariffs and how China response to it.

1) Retaliatory Tariffs

In response to the U.S. imposing tariffs up to 145% on Chinese goods, China has enacted 125% tariffs on U.S. imports, intensifying the trade conflict.

2) Boeing Aircraft Orders Halted

China has suspended deliveries of Boeing aircraft and related equipment, affecting pending orders from major Chinese airlines. This move significantly impacts Boeing, as China represents a substantial portion of the global aviation market.

3) Luxury Brand Manufacturing Exposed

Chinese manufacturers have highlighted that many luxury brands, such as Gucci and Louis Vuitton, produce their goods in China. This revelation challenges traditional perceptions of luxury brand origins and may influence consumer sentiment.

1.1 THE POTENTIAL IMPACTS

1) Economic Tensions Escalate

The tit-for-tat tariffs intensified the trade war, leading to uncertainty in global markets and disruptions in supply chains.

a) Aviation Sector Losses

Boeing, one of the U.S.'s top exporters, could face substantial financial losses due to halted Chinese orders, which traditionally represent a significant share of its business.

b) Brand Reputation and Consumer Perception - by exposing the manufacturing origins of high-end Western brands, China may influence consumer sentiment-especially among nationalist buyers in both China and the West. This could lead to reduced demand or increased scrutiny over pricing and branding strategies.

c) Shifts in Manufacturing Strategies

Brands might reassess their manufacturing base to diversify away from China, potentially accelerating the trend of "friendshoring" or relocating production to other countries.

d) Diplomatic Strain

These economic measures often ripple into diplomatic relations, potentially stalling cooperation in other critical areas such as climate change, technology, and regional security.

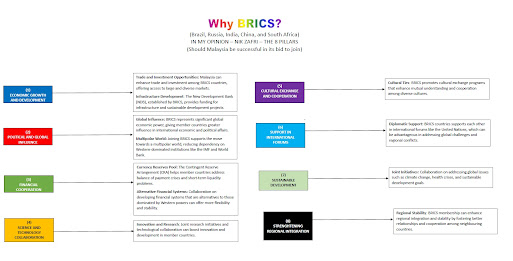

2.0 BRICS AND BRICS+

Photo Source : BNE IntelliNews

2.1 Diversification of Alliances

Southeast Asian nations are strategically balancing their relationships between Western powers (like the US and EU) and emerging powers. BRICS (Brazil, Russia, India, China, South Africa, now also including countries like Egypt, Ethiopia, Iran, etc. possibly Malaysia anytime soon) offers an alternative pole to the Western-dominated institutions like the IMF and World Bank.

2.2 Economic Opportunities

China and India, the two largest BRICS economies are major trading partners and investors in the region. With the rise of the Belt and Road Initiative (BRI), infrastructure investments from China have been pouring into SEA, making the economic pivot even more appealing.

2.3 DE-DOLLARIZATION??

There’s a growing trend among BRICS countries to move away from reliance on the US dollar in trade settlements. This appeals to SEA nations who want to shield themselves from dollar-based sanctions and the volatility of US monetary policy.

2.4 Inclusive Development Philosophy

BRICS often promotes a narrative of mutual development without the governance and policy strings typically attached to Western aid and loans. This resonates with many SEA leaders who prefer more autonomy in domestic affairs.

3.0 WILL THE YUAN EVENTUALLY DOMINATE REGIONAL CURRENCY USE?

I would say possibly, but with caveats.

3.1 Increasing Use

Some ASEAN countries have started using the Yuan in bilateral trade and as part of foreign reserves (e.g., Malaysia, Indonesia).

But there are still possible hurdles to jump:

a) The Yuan may still not fully convertible.

b) Trust and transparency issues with China’s monetary policy persist.

Currently most SEA countries still prefer a basket of currencies rather than dependence on any single one be it the USD or Yuan.

Yuan usage may grow regionally as an alternative or in parallel with the dollar, but a complete shift or dominance is unlikely in the short term unless China introduces greater financial transparency and liberalization.

4.0 WILL GOLD BE REPLACED BY OTHER PRECIOUS METALS TO BACK A CURRENCY?

Photo Source : Investopedia

For now, I would say unlikely, but everyone must know alternative hedging is rising and trending.

4.1 Gold’s Role

Gold has always been the most stable and globally accepted store of value. BRICS countries (especially Russia and China) are already increasing their gold reserves as a hedge against the dollar.

4.2 Alternatives like Rare Earths or Platinum?

These are valuable, but they lack the same liquidity and price stability and may not be universally accepted role as gold.

However, in a diversified reserve strategy, countries might add platinum, silver, or strategic resources (like lithium) into sovereign wealth portfolios but not necessarily to directly back a currency.

4.3 Digital Currencies with Metal Backing?

There's growing interest in CBDCs (Central Bank Digital Currencies) backed partially by tangible assets including metals, but this is still exploratory.

5.0 IMPORT TARIFFS ON CHINESE AUTOMOBILE

Photo Source : carlogos dot org

Then came the issue of import tariffs on Chinese automobiles to the U.S. is heating up again and it's quite layered. Here's a breakdown of the current state, why it's happening, and what it means going forward.

5.1 Current Status (as of 2025)

a) High Tariffs Still in Place

The U.S. continues to impose significant tariffs on Chinese-made vehicles, often around 27.5% or more, combining the base tariff and additional duties from the Trump-era trade war (ironically which Biden-era policy hasn't fully reversed).

b) EV-Specific Concerns

The U.S. is particularly wary of cheap electric vehicles (EVs) from China (like BYD, NIO, XPeng), fearing they could flood the market and undercut American automakers like Tesla, Ford, and GM.

c) National Security and Technological Transfer

Concerns aren’t just economic, Washington worries that Chinese EVs could pose data privacy risks due to smart car features, and could be a vector for technological espionage or influence.

d) Why the U.S. Is Maintaining (or Even Considering Raising) These Tariffs

i) Protecting Domestic Industry

With massive investments under the Inflation Reduction Act (IRA) and CHIPS Act, the U.S. is trying to rebuild its manufacturing and EV ecosystem. Chinese imports are seen as a threat to that goal.

ii) Political Pressure

In an election year or geopolitical tension (e.g., Taiwan Strait, South China Sea), being "tough on China" scores bipartisan political points. Tariffs are one of the few tools with support across the aisle.

e) Leveling the Playing Field

U.S. officials argue that China’s auto sector enjoys heavy state subsidies, skewing competition. Tariffs are a way to counteract that imbalance.

WHAT WOULD BE THE LIKELY IMPACTS AND IMPLICATIONS

(Both countries including the consumers could be affected)

A) For China

i) Limited U.S. Market Access

Chinese automakers are turning to Europe, Latin America, and Southeast Asia instead.

ii) Brand Recognition Lag

Without presence in the U.S., Chinese EV brands may miss out on one of the world's largest and most influential auto markets.

B) For the U.S.

i) Slower EV Adoption? Tariffs may keep prices high for consumers in the short term, especially for affordable EV options.

ii) Domestic Growth - on the plus side, tariffs give U.S. automakers more breathing room to innovate and scale.

C) For Consumers

Less variety and potentially higher prices in the short term, especially for entry-level EVs that China could offer at lower cost.

WHAT’S NEXT THEN

a) WTO Challenges

China may raise disputes in the World Trade Organization, but the U.S. has deprioritized WTO rulings in recent years.

b) Possible Tariff Adjustments?

Future U.S. administrations might revise tariffs depending on domestic EV competitiveness and broader U.S.-China relations.

c) Chinese Automakers Going Indirect

Some companies are considering setting up plants in Mexico or Southeast Asia to bypass tariffs under trade deals like USMCA.

6.0 US 90-DAY HALT OR TARIFF FLOAT

Will this help?

6.1 Short-Term Halts Offer Limited Relief

Personally I feel that the 90-day tariff suspension or "float" - was intended to ease tensions and allow room for negotiation again, based on what’s going on right now, it did little to reverse the underlying issues:

6.2 Market Skepticism

Investors and global markets largely saw the pause as a tactical delay rather than a genuine shift in U.S. trade policy.

6.2 No Structural Changes

The core grievances, such as intellectual property concerns, subsidies for Chinese industries, and national security risks, remained unaddressed.

6.4 Policy Whiplash

With no long-term roadmap, the halt created confusion among businesses relying on stable trade frameworks.

6.5 Minimal Impact on Supply Chains

The uncertainty discouraged companies from making major investments or altering supply chain strategies, knowing tariffs could snap back at any time.

7.0 GLOBAL ECONOMIC IMPACTS OF US-CHINA TARIFF TENSIONS AND BRICS REALIGNMENT

7.1 Slower Global Growth

- The IMF and World Bank have warned that prolonged trade wars between the U.S. and China could shave off 0.5% - 1% from global GDP annually,

- Supply chain disruptions, higher input costs, and export/import barriers slow trade momentum globally.

7.2 Rising Inflation Pressures

Tariffs on goods (e.g., automobiles, electronics, food items) raise production and retail costs, feeding inflation not only in the U.S. but also in countries dependent on those trade routes.

7.3 Global Supply Chain Realignment

Companies are diversifying away from China (the “China+1” strategy), shifting manufacturing to countries like Vietnam, Mexico, and India.

Friendshoring and nearshoring gain traction, but reconfiguring supply chains is costly and can take years, causing short- to medium-term instability.

7.4 Currency Volatility and DeDollarization

Moves by BRICS to de-dollarize assuming if successful may weaken the dollar’s dominance, leading to :

- Exchange rate fluctuations,

- Higher hedging costs for global businesses,

- A possible rise in regional currency blocs, complicating international trade settlements.

7.5 Technological and Standards Fragmentation

As the U.S. restricts tech access to China (semiconductors, AI, etc.) and China develops parallel systems (e.g., its own 5G, EV, and payment standards),

I would predict :

- a bifurcation of global technology ecosystems,

- Businesses forced to choose between Western and Chinese standards, raising R & D and compliance costs.

7.6 Reduced Consumer Choice and Higher Prices

- Fewer global options in goods (especially EVs, tech, luxury items).

- Consumers may face fewer affordable choices, particularly in lower-income markets.

7.7 Trade Bloc Polarization

The rise of BRICS+ and possible alignment of countries like Saudi Arabia, Iran, Malaysia and Indonesia suggests a multipolar economic world, with parallel systems forming trade blocs may prioritize internal trade within BRICS or Global South, bypassing traditional Western markets.

WTO’s role could diminish further.

7.8 Capital Flow Redirection

Global investment funds may pivot to BRICS nations or emerging markets aligned with China/India as infrastructure and trade ties deepen.

U.S. and European firms may face barriers or political scrutiny for investing in or importing from China.

7.9 Global Cooperation Undermined

Trade disputes and power polarization make climate cooperation, global health (like post-pandemic coordination), and digital governance more difficult.

8.0 IMPACTS ON THE GLOBAL STOCK MARKET AND OTHER FORMAL INVESTMENTS

8.1 Short-Term Impacts on Global Stock Markets

a. Increased Volatility

- Trade wars and tariff announcements tend to spook investors, especially in export-heavy sectors like tech, automotive, aviation, and manufacturing,

- Stock indices (S&P 500, Nikkei, Hang Seng, etc.) may react with sharp swings as market sentiment responds to escalating tensions or diplomatic breakthroughs.

b. Tech and EV Sector Pressures

U.S. tech firms with global supply chains (like Apple, Tesla) could face higher costs and reduced sales if retaliatory tariffs are expanded.

Chinese EV stocks may struggle with restricted access to Western markets (especially the U.S.), though they could gain traction in BRICS or developing countries.

c. Flight to Safety

In uncertain times, investors often shift toward safe-haven assets: gold, U.S. Treasuries, Swiss francs, and defensive stocks (healthcare, utilities).

Emerging markets may suffer temporary outflows unless they are seen as benefitting from supply chain realignments (e.g., Vietnam, India, Mexico).

8.2 Medium-to-Long-Term Impacts on Formal Investment

a. Rerouting of Foreign Direct Investment (FDI)

Southeast Asia, India, and Latin America are becoming new magnets for FDI as companies "de-risk" and reduce dependence on China.

Investments in infrastructure, logistics, and digital ecosystems in these regions are expected to grow, boosted by Chinese and BRICS funding.

b. Reshoring and Friendshoring Boosts Developed Markets

The U.S., Europe, and Japan will attract capital for high-tech manufacturing, clean energy, and semiconductor fabs, backed by incentives from government stimulus packages (e.g., CHIPS Act, IRA).

This will shift long-term investor focus toward industrial and clean-tech sectors in developed markets.

c. Rise of Sovereign Wealth Funds and State-Controlled Capital

Countries in BRICS+ and resource-rich states (e.g., UAE, Saudi Arabia, Russia) may channel more capital through sovereign wealth funds, focusing on strategic assets and geopolitical leverage.

This trend will challenge traditional Western institutional investors, like pension funds and private equity, especially in infrastructure and energy.

d. Currency Diversification and Portfolio Shifts

As countries increase trade in Yuan or local currencies, demand for U.S. dollars may weaken slightly, impacting dollar-based assets and Treasuries.

Portfolio managers might diversify more aggressively into gold, commodity ETFs, or Yuan-based instruments, albeit cautiously due to transparency concerns.

MY ADVICE TO INVESTORS

The age of passive investing in a “globalized” world may be giving way to active, geo-aware investment strategies. Markets will become more fragmented, and geopolitical literacy will become as crucial as financial analysis.

Investors will need to track:

- Currency shifts

- Regional alignments

- Tech and trade regulation changes to navigate the new world economy.

Top Opportunities:

- Southeast Asia: Manufacturing, logistics, digital infrastructure

- India: Infrastructure, renewable energy, tech platforms

- Defense/Cybersecurity: Global demand surge amid geopolitical tensions

- Gold and critical minerals: Hedge assets with long-term growth

Investment Strategy Tips

- Diversify across emerging markets - focus on India, Vietnam, Brazil.

- Look for ETFs and funds with exposure to critical minerals, defense, or green infrastructure.

- Watch central bank policies - especially regarding Yuan, gold-backed assets, or BRICS currency talks.

- Stay updated on trade policy headlines, especially in an election year or diplomatic flashpoints.

9.0 JAPAN AND KOREA

Japan and South Korea are in a delicate position amidst the growing BRICS+ influence and the US-China tariff tensions. Both countries are allies of the U.S., but are also deeply economically tied to China. Here's how their reaction might play out:

9.1 Japan

a. Cautious Alignment with the West

- Japan will likely maintain its strategic alignment with the U.S., especially through Quad (with India, U.S., and Australia),

- Concerned about BRICS+ weakening Western economic influence, particularly if BRICS+ pushes for a new trade or financial system (like reducing USD reliance),

- Quiet Diplomacy in Asia - Japan may seek to strengthen bilateral ties with ASEAN countries and India as a counterbalance to China-led coalitions.

- Increased investment in alternative trade routes (e.g., Indo-Pacific economic frameworks).

b. Economic Guardrails

Japanese companies may diversify supply chains away from China (China+1 strategy) to reduce exposure amidst tariff uncertainty.

Possible deeper engagement with the EU and TPP countries.

9.2 South Korea

a) Economic Pragmatism

South Korea is more economically dependent on China than Japan, so it may adopt a pragmatic dual-track strategy :

i) Align "politically" with the U.S.?

ii) Maintain economic ties with China.

b) Watchful but Non-Committal on BRICS+

i) Korea is unlikely to join or support BRICS+ directly, but may observe closely to avoid economic isolation in the region.

ii) Will likely support multilateral forums like the G20 or APEC as neutral grounds.

c) Tech and Supply Chain Strategy

Korea have may to push harder for tech sovereignty and work with Japan, Taiwan, and the U.S. to build resilient chip and battery supply chains (especially in semiconductors).

Increase investments in Southeast Asia is likely to happen as alternative markets.

10.0 IMPACT OF THE TRUTH IN LUXURY BRANDS MADE IN CHINA

Yes, many European and U.S. luxury brands do manufacture in China; often quietly; for cost reasons. But once that becomes widely known to average consumers, it creates a crisis of perception, especially for brands that rely heavily on exclusivity, heritage, and craftsmanship.

10.1 What Might Happen to Luxury Brands?

a) Lowering Prices?

Unlikely. Luxury brands thrive on perceived value, not cost of production. Lowering prices would -

- Undermine brand prestige,

- Confuse their market positioning,

- Alienate their core high-end clientele

INSTEAD THEY MIGHT

- Diversify production (move some operations to Italy, France, or other "prestige" locations?)

- Use "Made in" "rebranding " (e.g., "Designed in Paris", "Assembled in Europe")

b) Go Busted?

Not in the near term.

But they risk losing the middle-class aspirational buyer, especially in the U.S., if that group starts buying directly from China (via Temu, AliExpress, DHgate, etc.).

Gen Z and Millennials are value-driven and increasingly brand-skeptical, which could gradually erode the luxury market’s mass segment.

c) Shift in Consumer Behavior

U.S. consumers are getting savvier realizing that a $1,200 bag may cost $60 to make in China.

Platforms like Temu, Shein, and Alibaba offer stylish knockoffs or similar-quality goods for a fraction of the price.

This shift threatens mid-tier luxury more than ultra-premium (e.g., Hermes, Patek Philippe).

d) Internet Restrictions? : Is the U.S. Blocking Access to China Shopping Sites?

So far, not fully, not yet , but there’s growing scrutiny:

- Temu and Shein have faced U.S. congressional attention for labor practices and data concerns,

- TikTok Shop was targeted with potential bans.

- The U.S. may increase tariffs, restrict app operations, or limit financial flows, rather than impose a complete internet block.

Google Ads, Facebook Ads, and Instagram promotions from Chinese vendors are still very active, and many ship freely to the U.S.

11.0 RUSSIA

Russia’s next moves in this evolving global landscape will be highly strategic and driven by its goal to counterbalance Western influence, protect its economy from sanctions, and solidify its leadership role within BRICS+ and the multipolar world order. Here’s what Russia is likely to do:

11.1 Russia’s Strategies for 2025 and Beyond

a. Strengthen BRICS+ as an Economic Bloc

Russia is pushing for a multipolar financial system less dependent on the U.S. dollar or Western institutions.

It will continue championing the creation of a BRICS settlement system, possibly backed by gold or commodities, to facilitate trade between member states.

Key actions:

- Promote Yuan, Ruble, Rupee-based trade with SEA, Middle East, Africa, and Latin America,

- Push for an alternative to SWIFT, like the SPFS (Russia’s financial messaging system) or China’s CIPS.

b. Resource Diplomacy

Russia may leverage on :

- Energy (oil, gas exports to China, India, Turkey),

- Fertilizers, wheat, and grains (to Africa and Middle East)

- Rare earths and industrial metals (critical to green transitions)

The goal is to secure long-term bilateral trade deals outside Western systems, priced in local currencies or through barter-style arrangements.

c. Military and Strategic Alliances

Deepen military cooperation and defense exports to non-Western nations:

- Southeast Asia (Vietnam, Myanmar),

- Africa (Mali, Central African Republic, Sudan),

- Iran, Syria, and Central Asia

Russia may present itself as a reliable alternative to NATO-aligned arms suppliers.

d. Geopolitical Counterweights

Continue engagement via diplomacy through:

- Peace talks or arbitrage roles (e.g., between Iran and Arab states, or in African conflicts)

- Participation in regional blocs (EAEU, SCO) to deepen integration outside of the West

Example: Russia positioning itself as a strategic backer of Iran, Syria, and the Sahel region while simultaneously trying to broker "stabilizing" roles.

e. Digital and Financial Innovation

Russia is fast-tracking digital ruble development (CBDC), and may explore a BRICS-backed crypto or commodity-linked stablecoin,

Could use blockchain-based systems to evade sanctions, attract crypto-aligned investors, or facilitate cross-border trade in non-dollar terms.

CHALLENGES FOR RUSSIA

a) Economic

Sanctions continue to block access to tech, banking, and markets

b) Military

Overextension due to ongoing conflicts (Ukraine) and defense budget strain

c) Demographics and Workforce

Shrinking population and brain drain

d) Global Perception

Limited appeal in Western-aligned countries due to war and governance issues

Russia is no longer trying to reintegrate with the Western economic system. Instead, it's building a parallel ecosystem with BRICS+, based on sovereignty, resource control, and multipolar diplomacy.

12.0 PALESTINE

The shifting global power dynamics especially around BRICS+, China-Russia strategies, U.S. tariffs, and de-dollarization may not directly impact Palestine in the short term, but there are subtle and long-term ripple effects worth exploring.

How Global Geopolitical Shifts May Impact Palestine

12.1 Greater Political Support from the Global South

Countries like Russia, China, Iran, South Africa, and Turkey have increasingly expressed support for Palestinian rights at international forums.

As BRICS+ grows in strength, Palestine may gain a stronger diplomatic platform outside of the U.S.-led global order.

12.2 Shift in Aid and Investment Flows

As BRICS nations increase economic coordination, new channels of development aid or investment (e.g., through the BRICS New Development Bank) could become available to the Palestinian Authority or Gaza reconstruction, bypassing Western donors.

However, actual disbursement would depend heavily on regional stability and governance.

12.3 Reduced Leverage of Western Powers

If U.S. influence weakens due to trade wars or loss of dollar hegemony, it could reduce Washington’s ability to shape Middle East policy unilaterally.

This may open the door for multi-party mediation (China, Russia, or Arab League-led) on the Israeli-Palestinian conflict.

12.4 Proxy Dynamics Intensify

In a polarized world, Palestine may become a symbolic battleground between pro-West and pro-BRICS blocs.

Conversely, Gulf countries (e.g., UAE, Saudi) may balance cautiously to preserve ties with both the U.S. and BRICS.

12.5 Media and Narrative Battle

With China and Russia investing heavily in global media influence (e.g., CGTN, RT), Palestinian narratives may gain more visibility in the Global South, challenging Western media framing.

13.0 UKRAINE AND OTHER NATIONS

Ukraine? Where the Shifts Leave It?

13.1 Continued Dependence on the West

Ukraine remains deeply reliant on U.S. and EU military, financial, and humanitarian aid.

As U.S. attention shifts to China and the Indo-Pacific, Ukraine fears donor fatigue, especially in Congress and Europe.

If the U.S. economy slows or faces a political shift, Ukraine could see delays or cuts in aid packages.

13.2 Diplomatic Gridlock at the UN

With China and Russia holding veto power, meaningful action against Russia through the UN Security Council remains impossible.

Ukraine must instead rely on non-binding UNGA resolutions and bilateral coalitions.

13.3 BRICS+ May Mediate, But with Bias

Some BRICS+ members (like Brazil or South Africa) have tried to propose peace frameworks.

13.5 Other Conflict Zones (e.g., Syria, Sudan, Yemen, Myanmar)

a) Reduced U.S. Focus

As the West focuses on China containment, energy security, and reindustrialization, these conflicts get less attention, especially if they’re not strategic to Western supply chains or critical resources.

b) Will Russia and China Step In?

Russia and China increasingly position themselves as peace brokers or allies to regimes sidelined by the West.

c) Proxy Warfare Intensifies

In places like the Sahel, Sudan, and parts of the Middle East, conflicts are turning into proxy battlegrounds between:

- Western allies (France, U.S., NATO)

- BRICS-aligned or non-aligned forces (Russia via Wagner, Iran, Turkey)

14.0 MICROSOFT DATA CENTERS

The ongoing tariff tensions between China and the US could definitely affect Microsoft Data Center projects, especially those that depend heavily on Chinese contractors, equipment, or materials.

14.1 Possible Construction Delays?

-

Reason: If Microsoft is using Chinese contractors or sourcing key components (like prefabricated modules, HVAC systems, or even electrical switchgear) from China, tariffs or export controls could cause delays,

-

Impact: Delivery schedules may be extended due to customs hold-ups or the need to find alternative suppliers.

- Reason: Tariffs can increase the cost of imported Chinese construction materials, tech components, or services,

- Impact: Microsoft (or its subcontractors) may see higher build costs, which can impact budgets for new data centers or expansions.

- Reason: Tensions may lead to restrictions on certain technology transfers, materials (e.g., rare earth metals), or components,

- Impact: Supply chain risks might require Microsoft to diversify vendors, possibly leaning more on domestic or non-Chinese suppliers.

- Microsoft may restructure procurement strategies to emphasize local or allied-country contractors,

- Greater localization of design and build processes might be implemented to avoid geopolitical risk,

- Expect more investment in automation and modular construction to mitigate labor and supply vulnerabilities.

- Diversify supply chain (multi-country sourcing),

- Shift data center builds to local EPC (Engineering, Procurement, and Construction) partners,

- Stockpile critical components or use alternate technologies not sourced from China,

- Strengthen risk assessment in project planning stages.

a) Dependency on Advanced Chips

Use in Data Centers: Microsoft relies heavily on advanced GPUs and CPUs (e.g., NVIDIA, AMD, Intel) for AI workloads, edge computing, and virtual machines in Azure.

Issue: Many of these chips are either manufactured in Asia (e.g., TSMC in Taiwan) or use components that originate from or pass through China.

b. US Export Restrictions

Background: The US has placed restrictions on exports of high-end semiconductors and manufacturing tools to Chinese companies, especially those linked to AI or military use.

Impact: If Microsoft’s Chinese contractors or suppliers are involved in chip assembly or testing, they may get caught up in these restrictions - leading to supply delays or redesigns of component sourcing.

c. Supply Chain Fragility

The semiconductor supply chain is complex and global - even if a chip is designed in the US, parts of it may be:

- Fabricated in Taiwan or South Korea,

- Packaged or tested in China,

- Assembled with Chinese components

Impact: Any disruption - tariffs, blacklists, or even political instability can cause ripple effects across data center deployment timelines and costs.

d. Cost of Semiconductors Rising

Due to demand surges, export restrictions, and geopolitical tensions, the price of key chips (especially GPUs like NVIDIA’s H100s) has skyrocketed.

Impact on Microsoft: Higher capital expenditure (CapEx) for deploying AI infrastructure in their data centers, potentially impacting the rollout speed of new Azure regions or services.

e. Shift Toward Self-Sufficiency

Microsoft's Response: Like other tech giants, Microsoft is investing in developing its own chips (e.g., the Azure Maia AI chip and Cobalt CPU) to reduce reliance on third-party semiconductors.

Trend: Expect more in-house silicon development, strategic partnerships (like with AMD or Intel), and closer relationships with non-Chinese foundries (e.g., TSMC, Samsung).

f. National Security Pressures

The US government may pressure companies like Microsoft to ensure that no Chinese-sourced semiconductors are used in critical infrastructure (e.g., government cloud services or defense-related computing).

This could limit Microsoft’s supplier flexibility and force more expensive workarounds.

15.0 FUEL PRICES

Fuel prices are highly sensitive to the kinds of geopolitical and economic shifts we're discussing especially BRICS+ expansion, U.S.-China tensions, and global market realignment.

15.1 BRICS+ Influence on Oil Markets

BRICS+ includes major oil producers like Russia, Saudi Arabia, Iran, and the UAE.

They’re increasingly trading oil in non-dollar currencies, like the yuan, rupee, or even a potential BRICS+ currency.

If this trend continues, it could weaken the petrodollar, shift global pricing mechanisms, and cause volatility in fuel markets.

Effect:

Fuel prices could become less predictable and fluctuate depending on currency and alliance-based deals.

15.2 U.S.-China Tariff Tension

Tariffs can raise the cost of refined oil products and industrial fuels, especially if supply chains are affected.

If the U.S. imposes new restrictions on Chinese technology or energy logistics, China might respond by reducing cooperation or redirecting oil flows from U.S.-aligned nations.

Effect:

Short-term fuel price spikes, especially in Asia and the U.S., due to logistical reconfiguration.

15.3 OPEC+ and Strategic Alliances

With more nations joining BRICS+, including top OPEC players, the group could start controlling production more tightly.

If BRICS+ uses oil as a bargaining chip in global power plays, we could see intentional supply cuts (as we’ve seen with Saudi Arabia and Russia).

Effect:

Artificial price inflation especially during elections, major diplomatic events, or sanctions,

15.4 Alternative Energy Acceleration

The West (especially EU and the U.S.) may double down on green energy investments to avoid dependence on BRICS+ fossil fuels.

In the transitional period, fuel prices may spike due to uncertainty and investment gaps.

Effect:

Medium-term volatility, but possible long-term downward pressure on fuel as renewables grow.

16.0 PRESIDENT XI-JINPING’S CURRENT VISITS

President Xi Jinping's recent state visits to Vietnam, Malaysia, and Cambodia from April 14–18, 2025, could be closely linked to the broader geopolitical and economic shifts discussed earlier. These visits aim to strengthen China's regional ties amid escalating trade tensions with the United States.

The likely key objectives of the visit would be :

a) To counter U.S. Tariffs and Protectionism

In response to the U.S. imposing significant tariffs on Chinese goods, President Xi emphasized the importance of multilateral trade systems and criticized protectionist policies during his Southeast Asia tour.

b) Strengthening Economic Partnerships

Malaysia : China and Malaysia signed 31 agreements covering sectors such as trade, tourism, railway transportation, and agriculture,

Vietnam: The two countries signed memorandums on cooperation in supply chains, railroads, and environmental protection,

Cambodia: Discussions focused on infrastructure projects like the $1.7 billion Funan Techo Canal, with Cambodia seeking increased financial support from China.

c) Promoting Regional Stability and Security

President Xi's visits could also be aimed to reinforce China's commitment to regional peace and stability, particularly in the South China Sea, and to deepen defense partnerships, as seen in agreements with Vietnam.

d) Advancing the Belt and Road Initiative (BRI)

The visits provided opportunities to integrate regional infrastructure projects into the BRI framework, enhancing connectivity and economic integration across Southeast Asia.

e) Global Economy

i) Shift in Trade Dynamics

China's efforts to strengthen ties with ASEAN countries may lead to a realignment of trade relationships, potentially reducing reliance on Western markets.

ii) Diversification of Supply Chains

Enhanced cooperation between China and Southeast Asian nations could result in more diversified and resilient supply chains within the region.

iii) Increased Regional Influence

By solidifying economic and political partnerships in Southeast Asia, China positions itself as a central player in regional affairs, potentially challenging U.S. influence.

17.0 CONCLUSION

THE GLOBAL ECONOMIC ORDER ARE NOW AT CROSSROADS

The unfolding events, from retaliatory tariffs between China and the U.S., rising protectionism, Southeast Asia’s pivot toward BRICS, and President Xi Jinping’s assertive diplomacy signalling a deep transformation in the global economic and geopolitical landscape.

What me and you all are witnessing is not just a trade dispute or regional realignment. It is the reshaping of the post–Cold War economic order:

17.1 Multipolarity Is Replacing Unipolar Dominance

The U.S.-led global system, anchored by the dollar and Western institutions like the IMF and WTO, is increasingly being challenged by a multipolar structure led by coalitions like BRICS+, which promise alternative development models, financial frameworks, and geopolitical alliances.

17.2 Southeast Asia Balances Prudently

ASEAN countries are not fully turning their backs on the West, but they are diversifying alliances. The Belt and Road Initiative, local currency swaps, and infrastructure deals with China offer economic pragmatism over ideological alignment. This reflects a growing desire among Global South nations to avoid being caught in great power rivalries.

17.3 Trade and Tech Wars Disrupt Global Integration

Tariffs, tech restrictions, and manufacturing reshoring are unraveling decades of globalization. While they may protect domestic industries in the short term, the long-term costs include:

- Slower global growth

- Higher consumer prices

- Less cooperation on global challenges like climate change and pandemic preparedness

17.4 China’s Strategic Countermoves Are Multi-Layered

China’s response to U.S. tariffs, by halting key imports like Boeing, exposing the manufacturing base of Western luxury brands, and tightening ASEAN partnerships demonstrates a calculated and resilient economic strategy. Xi Jinping’s recent diplomatic visits underline a push to secure China's influence in a region crucial to global supply chains and maritime security.

17.5 Currency and Commodity Shifts Are Coming?

If so, Yuan usage in trade will likely increase, but a full replacement of the dollar is unlikely without greater transparency and capital mobility. Gold will remain a key reserve asset, though some nations may begin hedging with other precious metals or strategic resources as part of broader diversification strategies.

SOME PEOPLE ARE CONCERNED THAT THIS MAY TRIGGER ANOTHER WORLD WAR

For the time being - HIGHLY UNLIKELY!

While the China-US tariff conflict has caused significant economic and geopolitical tension, it's unlikely to directly trigger another world war. The situation is more of a trade and diplomatic standoff, rather than an outright military conflict. Both nations are heavily intertwined economically, and a full-blown war would be devastating not only for them but for the global economy. That said, ongoing tensions could lead to further economic fallout, disruptions in global supply chains, and increased military posturing, which can destabilize international relations.

The real concern lies in the broader competition for global influence, particularly in regions like the South China Sea, Taiwan, and trade routes. But while economic and political rivalries could intensify, it's important to remember that modern conflicts are more likely to manifest through proxy wars, cyberattacks, and economic pressure rather than direct military confrontation. Still, the world has learned much from the devastating consequences of past wars, so it's in the best interest of both powers to manage their differences diplomatically to avoid escalating into something much larger.

WHAT DO I THINK?

I think the world is moving into an era of economic realism and strategic alignment. Tariffs, trade blocs, and new financial instruments are only the surface. Underneath lies a deeper transformation in how nations perceive sovereignty, resilience, and growth. In this fluid landscape, agility and diplomacy not dominance will define future prosperity.