Disclaimer : This brief article represents solely my personal research findings. I do not act as a representative of any mentioned party. The views expressed are strictly my own and do not represent those of the parties referenced herein. Additionally, I may not be updated with the latest insurance reporting procedures. Your input to rectify any inaccuracies in my research is greatly appreciated.

The Anti-Money Laundering, Anti-Terrorism and Proceeds of Unlawful Activities Act 2001 (“the Act”) came into force on 15.1.2001 is aimed at thwarting money laundering, terrorism financing, and the utilization of illicit funds. Reporting entities are mandated to disclose any dubious circumstances, as outlined in the Act, along with sector-specific directives or rules set forth by the Bank Negara Malaysia.

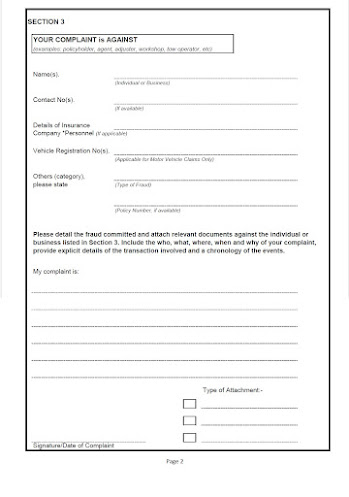

Insurance fraud entails engaging in deceptive actions to achieve illegitimate gains within an insurance procedure. It happens when either the insurer or the claimant seeks to acquire benefits they are not rightfully entitled to, or when an insurer deliberately withholds benefits rightfully owed.

Fraud like these adversely affects policyholders, resulting in millions of ringgits lost through elevated premiums and inflated prices for goods and services. Pinpointing the precise cost of insurance fraud proves challenging as a significant portion of instances remain undisclosed.

Examples of insurance fraud that may involve the claimant and/or be known to insurer officials include:

a. Fabricating Claims - Orchestrating staged accidents, such as fake "oil spillage" incidents or chain collisions, to gain possession of the vehicle(s) for repairs.

b. Exaggerating Loss Amounts - Submitting inflated claims where the severity of damage or injuries sustained in a legitimate accident is overstated.

c. Providing False Information for Compensation - Presenting inflated or "padded" claims where the extent of damage or injuries sustained in a genuine accident is misrepresented.

Quoting 14A. (1) of Anti-Money Laundering, Anti-Terrorism, Financing and Proceeds of Unlawful Activities Act (AMLATFPUA) 2001 :

Any person who knows or has reason to suspect that a reporting institution is proposing to report, is reporting or has lodged a report under section 14 or is proposing to provide, is providing or has provided any other related information to the competent authority and discloses such knowledge, suspicion or information to any other person commits an offence and shall on conviction be liable to a fine not exceeding three million ringgit or to imprisonment for a term not exceeding five years or to both.

In this context :

• Any person : claimant/insurer officials,

• Reporting Institution: Insurance Company,

• Competent Authority: Persatuan Insurans Am Malaysia (PIAM)

The competent authority duly authorized by BNM for reporting fraud is Persatuan Insurans Am Malaysia (PIAM).

However, I noticed some limitations:

Possible ambiguity regarding whether compliance officials (or a member of general public) can utilize the same form (FRCF) to report against another officials - if so, will it reach BNM or any other authority (will such insurance compliance official be protected under the Witness Protection Act 2009 (Act 696),

The general reporting period allocated is six (6) months but clarity is potentially lacking on other types of cases,

Unresolved issues can be reported to either the Ombudsman for Financial Services (OFS) or BNM.

Nevertheless, there appear to be limitations on BNM side in handling complaints of misconduct, which may not be consistent with Section 14 (A) of AMLATFPUA.

The reporting procedure by other institutions such as Banking and Financial Institutions are generally clear, but there appear to be "some exceptions" regarding reporting insurance incidents, which I consider vague, especially concerning officials reporting misconduct against another official.

If these are valid concerns - there's a need for improvement to ensure that there are no restrictions on disclosing reports directly to Bank Negara Malaysia, aside from PIAM or OFS.